2023 Tax Updates: What's New And What's Changed From 2022

The recent inflation surge has led to adjustments in taxes across the United States, and the decreased value of the U.S. dollar has prompted the IRS to make changes for the 2023 tax year. To ease the financial burden of inflation on American taxpayers, the IRS has raised the standard deduction, allowed more income to be taxed at lower rates, and raised the maximum income for lower long-term capital gains tax rates.

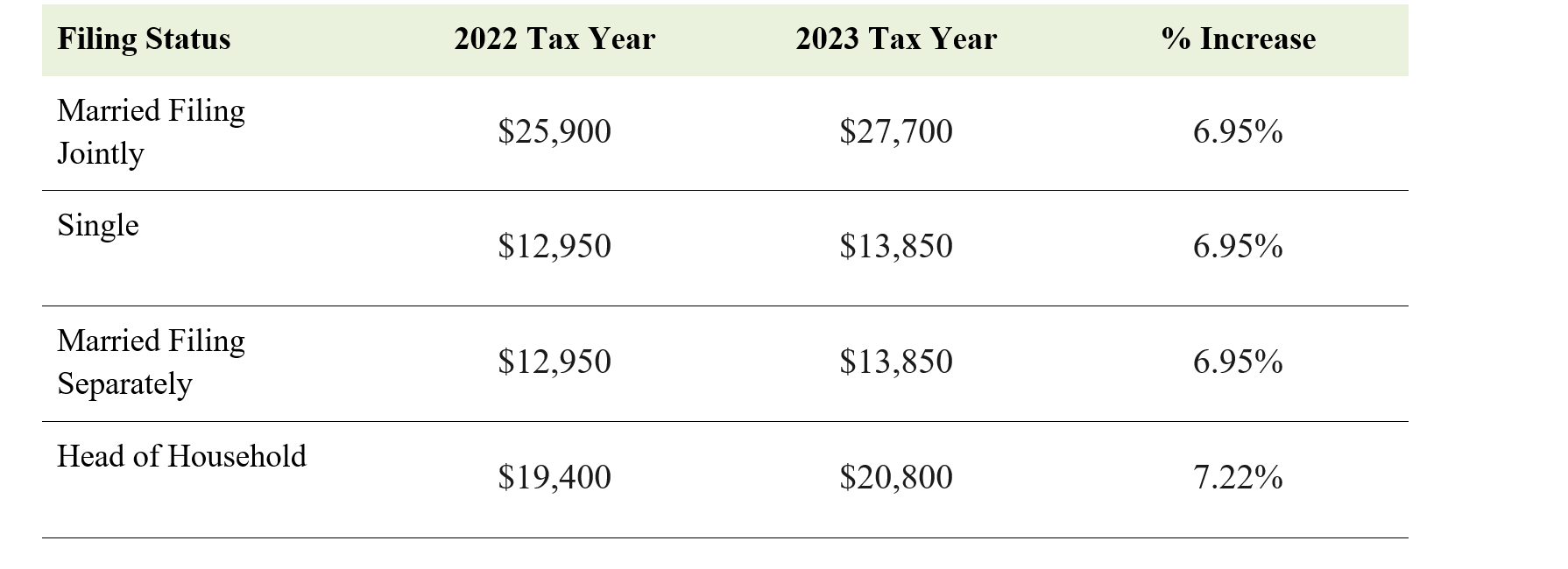

What is the standard deduction?

The standard deduction is the amount of money that may be deducted from your taxable income.

Standard Deduction

Here’s an example:

If you are a single taxpayer who makes $80,000 and you use the 2022 standard deduction of $12,950, you would only be taxed on $67,050 of the income you made in the year 2022.

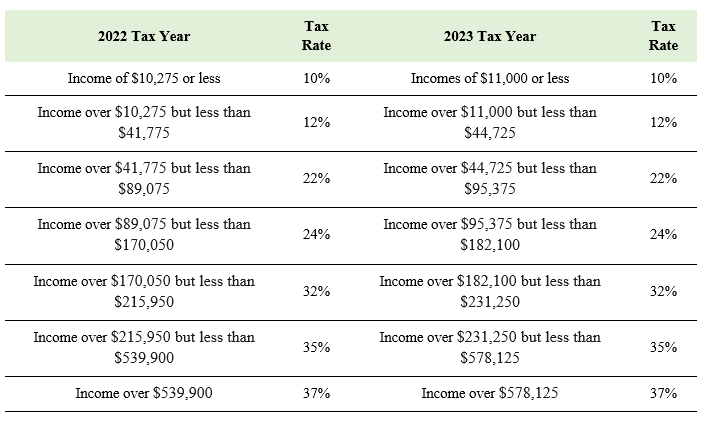

What is the income tax rate?

The income tax rate determines the percentage of your taxable income that will be taxed in each tax bracket.

It is important to understand that your income is not usually taxed at a single tax rate. The rate at which your income is taxed is determined by a bracket system. Portions of your income will be taxed at different rates, and as your income increases, so will the tax rate on your taxable income.

Here’s an example:

You are a single taxpayer with a taxable income of $50,000 who is filing taxes for the tax year 2023.

For the first $11,000 of the $50,000, you will be taxed at 10%: $11,000 x 0.10 = $1,100.00

The $33,725 between $44,725 and $11,000 will be taxed at 12%: $33,725 x 0.12 = $4,047.00

The remaining $5,275 of income will be taxed at 22%: $5,275 x 0.22 = $1,160.50

Adding up all of the taxes collected from each bracket will determine your total income tax: $1,100 + $4,047 + $1,160.5 = $6,307.50

You may notice that as a single taxpayer with the same income in the tax year 2022, you would pay more in income taxes.

Take a look…

$10,275 x 0.10 = $1,027.50

$31,500 x 0.12 = $3,780.00

$8,225 x 0.22 = $1,809.50

$1,027.50 + $3,780 + $1809.50 = $6,617.00

Using this example, you would pay $309.50 less in taxes for the tax year 2023 compared to 2022.

Tax Rate for Individual Single Taxpayers

Tax Rate for Married Couples Filing Jointly

Tax Rate for Married Couples Filing Separately

Tax Rate for Head of Household

What are long-term capital gains?

Long-term capital gains are profits made from the sale of an asset (such as real estate, stocks, or bonds) that have been held for more than one year. These gains are taxed at a lower rate than short-term capital gains, which are considered profits made from assets held for a year or less.

How do taxes for long-term capital gains work?

The taxed percentage of your capital gains will depend on your taxable income. Let’s say you have a taxable income of $100,000 as the head of household. In this case, you would pay a 15% tax on any of your long-term capital gains for the year.

Long-Term Capital Gains Tax Rate for Tax Year 2022

Long-Term Capital Gains Tax Rate for Tax Year 2023

For more information on tax adjustments in 2023: https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2023

For more information on tax adjustments in 2022: https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2022