Can Sentiment Predict The Market? What 40+ Years Of Data Teach Us About Emotions, Investing, And The Cost Of Waiting

You have probably felt it recently. You are doing the best you can, paying attention to the news, keeping up with your finances, and still trying to make the most of your summer. But then another headline rolls in: "Consumer sentiment falls again." Or "Investors are growing cautious about the economy." And you feel it in your gut: "Maybe now is not the time to invest." "What if I wait just a little longer, until things feel safer?" It is a very natural response. You are not wrong to feel it. But here is what I want you to know, gently and clearly: Waiting for things to feel better often means missing when things actually get better. This is not just an opinion. It is history. It is data. It is the reality behind over 40 years of studying how sentiment, or how we feel, aligns with how the market actually performs. Let's walk through it together. We analyzed over four decades of data to evaluate whether shifts in consumer and investor sentiment provide reliable foresight into either S&P 500 returns or U.S. real GDP growth. The results suggest that while sentiment reflects how people feel in the moment, it is not a reliable tool for making investment decisions.

What Is Sentiment and Why Do We Listen to It?

In the financial world, "sentiment" refers to the collective feelings of investors and consumers regarding the economy and markets. It is measured by two primary indicators:

AAII Bull-Bear Spread - The AAII Bull-Bear Spread is based on the American Association of Individual Investors (AAII) weekly sentiment survey. It measures the difference between the percentage of investors who are optimistic (bullish) and those who are pessimistic (bearish) about the stock market’s direction over the next six months.

University of Michigan Consumer Sentiment Index - The University of Michigan Consumer Sentiment Index is a long-standing, monthly survey that measures how confident U.S. consumers feel about the economy and their personal financial situation.

These indicators frequently make headlines. They are widely quoted by analysts and reporters. However, here is the thing: feeling better does not necessarily mean getting better.

Let's Look at the Data: 40+ Years, 2 Major Sentiment Indicators

We analyzed from 1987 to mid-2025, examining how changes in sentiment affected actual market performance and economic growth. Here is what we found:

Changes in investor sentiment explained just 11.8% of the variation in market returns.

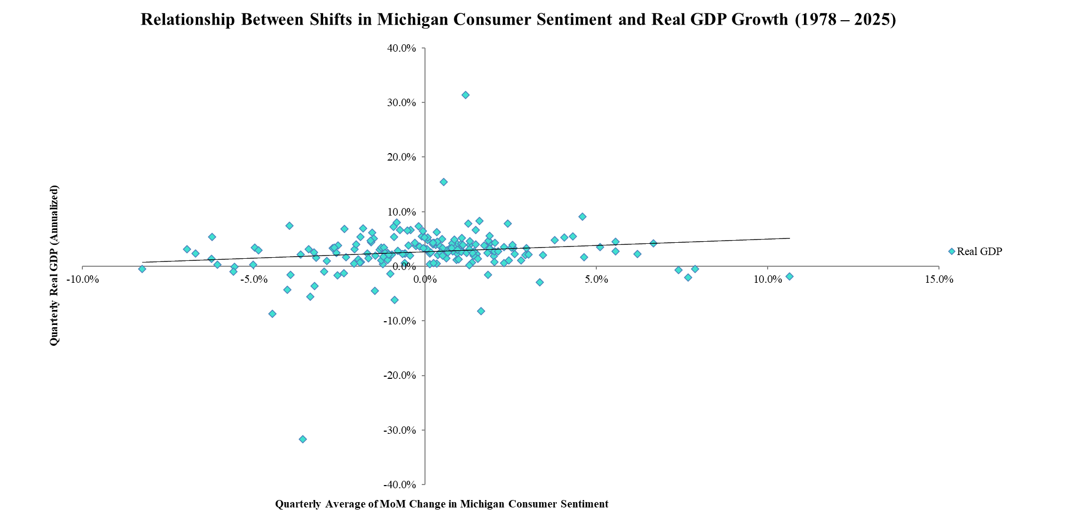

Changes in consumer sentiment explained less than 2% of U.S. economic growth (measured by GDP).

Let that sink in. Over 88% of what moves the stock market has nothing to do with how people feel. And almost 98% of the U.S. economy's growth is driven by factors beyond consumer emotion. This means that using sentiment to guide your investing decisions is like trying to drive cross-country using weather forecasts as your only map. Helpful at times? Sure. But reliable? No.

Real Life: 2020 and the Price of Waiting

Let's go back to March 2020. COVID shut down the world. Consumer sentiment plummeted. Investor sentiment hit the floor. And yet, the stock market began recovering just weeks later, well before anyone felt confident again. By the time many investors re-entered the market in late 2020 or 2021, when it finally "felt safe," the market had already gained over 60%. Some of the most significant gains had come and gone while people were waiting for the fog to clear. That is the hidden cost of letting feelings steer the ship.

Why Emotions Are Often Lagging Indicators

Here is what I want you to really understand:

Sentiment lags reality. Our emotions often react to what has already happened.

Markets are forward-looking. The price is not where we are, but where we are going.

By the time it feels good to invest, the best window may have already passed.

That is why investors who try to “wait until things feel better” often miss out on key growth opportunities. Not because they are uninformed or doing anything wrong, but because they are thoughtful people navigating uncertainty. We feel things deeply, especially when it comes to our money, our families, our futures. That is completely natural. But it is not a strategy.

What Actually Drives the Market?

If sentiment is not a strong predictor, what is? Over time, market growth is driven by fundamentals. These include:

Corporate earnings

Innovation and technology

Interest rates

Labor market strength

Demographics and productivity

Global trade dynamics

These are measurable. Trackable. And most importantly, these are the foundations of the financial plans we build with you. We do not react to headlines. We build strategies around your goals, time horizon, and the core health of the economy and markets, not just how people feel about them.

Teaching Moment: Feelings Are Real, Your Plan Keeps You Grounded

Let's be very clear: Your emotions matter. You are allowed to feel anxious, cautious, and uncertain. Especially when your money, your future, and your family are involved. But when those emotions start driving your decisions? That is where risk sneaks in. Here is what I lovingly encourage:

Please do not ignore your feelings, but do not let them be your investment compass.

Use them as a signal to talk, not to act impulsively.

Let your financial plan be your anchor, not the latest market sentiment.

You Are Not Your Sentiment

If you have been feeling unsure lately about the market, the economy, or your next move, I want you to remember this:

You are not alone.

You are not behind.

You are not your anxiety.

You are thoughtful. You are prepared. And you have a plan that is built not just for today but for the decades ahead. At Serene Financial Solutions, we walk with you through the full spectrum of life's seasons, from good to hard, and everything in between. We help you pause, reflect, and choose your next step with intention. Not panic.

Final Word

The market does not care how you feel. But we do. So the next time sentiment dips or soars, do not ask, "What does this mean for the market?" Ask, "How does this fit into the plan I have built for the life I want?" If you need a review, a refresher, or just a conversation about what is happening, we are here. Let's keep walking forward, together.

Sudden, big changes in investor feelings rarely predict important market moves. In fact, one of the best monthly gains happened when market mood barely changed, showing that markets often act very differently from how people expect based on emotions.

While the trendline showed a mild positive slope, the relationship was statistically weak and economically insignificant, with just under 2% of the variation in real GDP being explained by changes in consumer sentiment. Some of the largest GDP gains, including the 2020 recovery, occurred when sentiment remained subdued. These disconnects emphasize the limited value of sentiment data as a forward-looking economic signal.