Mastering Income Statements: Fundamental Analysis For Long-Term Investment

As a new investor, it can be daunting to choose the right stock from the numerous options available in the market. Each stock has its own advantages and disadvantages, making the selection process even more challenging. The question is, how can you identify a stock with great potential while avoiding the less promising ones? Answering this question will help you make informed decisions and kickstart your learning journey about the market. By exploring various strategies for selecting the right stock, you can gradually develop your ability to make sound investment decisions. This growth will help you understand the intricacies of the market and make informed, long-term investment choices.

At the core of sound investment strategies lies fundamental analysis, an indispensable toolset for investors focused on a company’s core value and performance. Fundamental analysis involves examining a company's financial health and operational effectiveness. For beginners, this means looking at stock prices and understanding the company's financial statements, such as income statements and balance sheets. It is about evaluating the effectiveness of the company's management and its position in the market compared to competitors. This thorough analysis helps investors understand a company's worth, which may differ from its current stock price. Temporary market trends and sentiments often sway a company’s stock price. This deeper insight is crucial for making well-informed, long-term investment decisions.

One pivotal facet of fundamental analysis revolves around examining a company's income statements to assess its financial well-being and future growth potential. These financial documents provide detailed information about a company's revenue, expenses, and profitability. They are an essential tool for fundamental analysis and making informed investment decisions. In this article, we will zoom in on simplifying the process of analyzing income statements and provide you with essential techniques for effectively gauging a company's financial status.

When investing in stocks, it is important to understand that you are essentially buying a small piece of a company. If the company succeeds, the value of your investment goes up, but if it fails, the value might go down. Therefore, your financial success is linked to the success of the company. Potential investors must understand the company’s financial health to determine whether a company is worth investing in. Income statements act like report cards, showing how much the company has made or lost. By analyzing these statements, you can make an informed decision about whether to invest in the company.

Therefore, it is important to understand that if you plan to hold onto a share in a company for a long time, you want to ensure the company is valuable. The company should attract new customers, improve profitability, create innovative products and services, and set itself apart from its competitors. Remember that a company's stock value is likely to be based on its fundamentals over the long term, such as revenue growth. Therefore, look for companies that are expected to grow in the future. Thankfully, there are relatively easy ways to analyze a company's fundamental value, and we will look at a few today.

Understanding an Income Statement

Revenue/Sales is a metric that indicates how effectively a company markets and sells its products and services. This figure reflects the company's ability to attract and retain customers. A higher revenue suggests that the company offers valuable products and excellent customer service, which is essential to maintaining a solid customer base. Understanding this metric can help you evaluate the company's market appeal and growth potential.

The Cost of Sales is a metric used to measure how well a company manages its expenses for producing goods or services. It is not enough to just focus on making sales; it is also essential for a company to control costs while ensuring quality. When a company can efficiently manage its costs, it retains more revenue from each sale, ultimately enhancing its profitability. This metric is a crucial indicator of a company's operational efficiency and ability to balance costs with quality.

Profit Margin is an essential financial metric that displays the difference between a company's sales revenue and expenses. This margin indicates how effectively a company can generate sales and control its expenses. The amount of profit remaining after deducting expenses like employee salaries and production costs from the revenue is the company's profit. This profit can then be reinvested in the business to fund areas such as research, marketing, and other operational activities, which can contribute to the company's growth and stability. For beginners, it is crucial to understand profit margin to evaluate a company's financial health.

Operating Expenses are the costs that a company associates with its day-to-day operations and growth. These expenses include rent, advertising, and investment in product development. It is common for companies to have high operating costs because they are essential for keeping the company competitive and operational. Although it is important to reduce expenses, substantial operating expenses can be beneficial if they lead to significant future returns. Striking a balance between efficient spending and wise investment in the company's growth is crucial. Understanding operating expenses is essential for assessing a company's long-term financial strategy.

A company calculates its operating income by subtracting the operating expenses from the operating revenue. Usually, large companies have lower operating costs and higher revenues than smaller ones. Large companies need less profit to fund their day-to-day operations. Companies generating high operating incomes attract investors seeking dividends because they usually distribute some of these profits. Investors must understand the relationship between operating costs and income to assess long-term profitability and dividend potential.

After paying taxes and other expenses, a company determines its net income or earnings, representing the leftover income. Companies with a robust net income often pay out a portion of the surplus funds to investors, which is a lucrative opportunity for potential investors. These dividend distributions are advantageous to investors as they offer the chance to earn passive income and signal that the company is profitable and willing to share its success “share the wealth.”

To put this all into context, let's take a quick look at Apple's 2023 Income Statement.

Apple has reported impressive sales figures of around $383 billion. This revenue is generated from the sale of their various products and services. However, this is not the total profit earned by the company. After deducting the costs of producing these products, Apple's gross margin or profit stands at a substantial $169 billion.

It is important to note that Apple incurs additional expenses apart from the cost of sales. The company allocates funds towards operating expenses, which include research and development, innovation, and introducing new products to the market. Moreover, operating costs such as selling, general, and administrative expenses (SG&A) cover crucial areas like product marketing and overhead costs. Together, these operating expenses amount to $54.8 billion, which results in an operating income of $114 billion.

After factoring in additional expenses, including taxes, Apple's net income reaches about $97 billion. The net income highlights the company's financial strength and operational efficiency.

Fundamental Analysis Ratios

After obtaining these numerical insights, the next step is to figure out how to interpret and utilize them effectively. In fundamental analysis, certain formulas are crucial in summarizing the vast amount of data in an income statement. These formulas allow us to evaluate a company's financial performance, particularly in profit and loss. Let's explore a few formulas that help us assess a company's performance with respect to profit and loss.

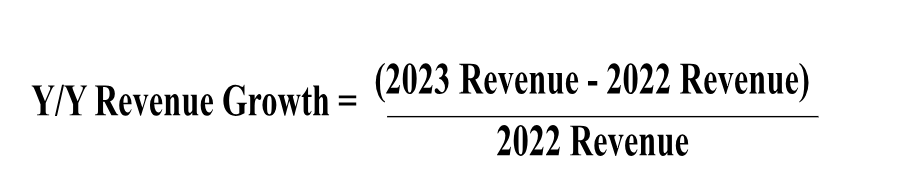

Year-over-year (Y/Y) revenue growth is a key metric that measures a company's revenue change from one fiscal year to the next. This calculation helps investors understand how a company grows financially over time, indicating sales and revenue generation trends.

The gross profit margin is an important financial ratio that calculates the percentage of revenue that exceeds the cost of goods sold. This margin shows how much each dollar earned goes towards the company's profit, indicating its efficiency in managing production and direct costs. It is a crucial indicator of financial health and operational effectiveness.

Much like the gross profit margin, the net profit margin calculates the profit earned from each dollar of revenue. This margin gives an insight into a company's overall efficiency after accounting for all expenses, including operating costs, taxes, interest, and other charges. It presents a comprehensive view of the company's profitability and financial health.

The operating margin is a financial ratio that helps calculate the percentage of operating income generated from each dollar of revenue. This ratio takes into account the necessary operational costs. It measures a company's operational efficiency by assessing how much revenue is converted into operating profit. Understanding how well a company manages its core business operations is crucial.

Analyzing a company's income statements to assess its performance is not enough. It is important to compare the company's stock value to its net profits. This comparison helps determine the value other investors place on the company relative to its profits. One way to do this is by examining the company's Price-to-Earnings (P/E) ratio. This ratio compares a company's stock price to its earnings per share (EPS), using earnings to appraise its underlying value and the stock share price to measure its market value. A higher P/E ratio indicates that the company is valued more highly by investors in relation to its profitability. A higher P/E may suggest the company is overvalued on the stock market.

Conversely, a lower P/E ratio suggests that the company's market value is lower relative to its earnings performance. A lower P/E ratio could mean the company is undervalued and trading at a discount. To determine whether a stock's P/E ratio is high or low, comparing it to other companies in the same industry is helpful, as P/E ratios can vary significantly between sectors.

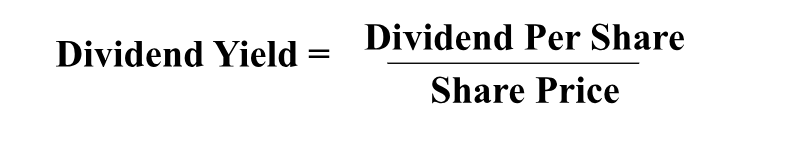

Another method to gauge a company's stock value based on its financial performance is to use the dividend yield ratio. This ratio calculates the percentage of a company's stock value paid out as dividends to its investors. Usually, companies with higher net income and financial stability can pay out more dividends to their investors. This ratio can be a valuable tool for investors looking for a passive income to help them decide which companies to invest in.

Choosing a Stock(s)

Analyzing a company's financial health before investing in it is essential. However, with so many companies listed on the US Stock Exchange, analyzing them all is not practical. One way to simplify the search is through Top Down Investing. This approach involves analyzing macroeconomic factors first and then narrowing down to specific economic sectors. For example, you can start by examining growing economies like the United States. Then, you can focus on a particular industry, like the technology sector, and narrow it down to cybersecurity companies. By comparing the financials of companies within the cybersecurity industry, you can make a well-informed investment decision. Comparison can help you avoid investing in companies that have not been performing well and highlight companies that have performed well in the past and are positioned for future growth.

The best investments usually come from companies growing and consistently improving their revenue and profitability. A company's stock valuations often reflect its revenue and profitability progress over time. Companies that continuously show revenue growth and improved profitability see an increase in their stock value in the long run. Suppose you need to decide which companies to invest in. In that case, you can use the Top-Down Investing strategy by starting with industries or sectors that are growing or expected to grow in the future. Additionally, investing in companies whose products or services you know and respect can help you make better investment choices. Investing in what you know, respect, and believe in is always a good idea, as this can increase your chances of achieving financial success in the stock market.