Money Relationships: Common Perspectives And Courses Of Action

Merriam-Webster defines relationships as a state of affairs between those having relations or a romantic/passionate attachment. In fact, you often read topics on money and relationships to discuss issues that couples tend to deal with as they learn better ways to manage money together. Today, however, we seek to explore the idea of money and relationships from a different perspective. How does our personal relationship with money impact our goal setting and overall financial management? Let’s explore a few common money perspectives and various checkpoints to consider under each perspective.

Perspective: Money is a Source of Happiness

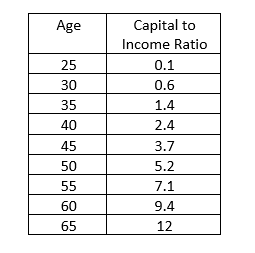

There have been various studies on the correlation between money and happiness over time. While some express the idea that income over a certain level does not create any proportionate levels of happiness, others may believe that additional income will finally grant them the happiness they may believe they are missing. What does this mean for personal financial management, though? While there is nothing wrong with money being connected to happiness, one must recognize the impacts on financial management. If you view money as a source of happiness, ensure that you set financial goals around building wealth over time. A quick check figure that can assist with this is the capital to income ratio. This ratio is explored in Charles Farrell’s “Your Money Ratios.” The ratio calculates the total value of your retirement accounts divided by total income. Based on Farrell’s calculation, the ratios below are targets at each respective age:

Perspective: Money is a Source of Stress or Fear

While some perceive money as a source of happiness, others view it as a cause of stress or fear due to a lack of financial literacy or fear of financial management mistakes. Stress or fear can be powerful motivators for money management. When this is the case, financial goals might be centered on improving financial knowledge and skills. Start small and explore free and low-cost resources available to aid in building an understanding of key financial management concepts. The Consumer Financial Protection Bureau publishes the Your Money, Your Goals Toolkit, an excellent starting place for building self-paced foundational financial management skills. Your Money, Your Goals services as a financial empowerment toolkit, walking readers through concepts of setting SMART financial goals, understanding credit reports and scores, building savings plans, and tracking income and expenses.

Perspective: Money is a Sense of Security

A final perspective we look at is money as a sense of security. When the desire for financial security is a driving factor for financial management, one must ensure proper focus has been placed on preparing for emergency situations. A key aspect includes building and maintaining a fully-funded emergency fund. Explore various options for building and maintaining an emergency fund here.

While this list is only a small sample of a wide variety of money perspectives and the ways in which one can address them, it’s a place to begin your journey. Remember that when examining your money relationship, emphasis should be made on financial management skills, personal perspectives, and their impact on personal financial management.