Paying For College Part I: I Want My Kids To Go…But Can We Really Afford That?

With the end of the academic year soon approaching, many parents are preparing to send their children off to college for the first time. According to the 2021 edition of Sallie Mae's How America Pays for College study, 6 in 10 (58%) college families developed a plan for funding all four years of college. Studies show that more and more families are beginning to make funding preparations for their children to obtain a college education. As families report an average of $26k for the academic year 2020-2021, a four-year degree is estimated to cost over $100k, which is far from a small price to pay. So, let's take a deeper look at how to create a detailed plan for your children from start to finish.

Let's begin with a fundamental concept: how much do we need to send our kids to college? To illustrate this concept in greater detail, we'll introduce Candice, a high school senior and aspiring lawyer, and her parents, Will and Dianne. Candice has spent the last year exploring different schools to determine where she wants to go, while her parents have been more concerned about how Candice's college education will get funded. Will and Dianne have not been setting aside funds specifically for Candice's college education over the years. While they do not wish to discourage her from pursuing her dreams of higher education, they also believe that the projected cost of her dream is beyond their financial means. So as Candice approaches her last few months of high school, Will and Dianne have begun getting more knowledgeable about the college-funding process.

According to How America Pays for College, college education costs were covered by the six distinct funding sources depicted below.

Sallie Mae. (2021). (rep.). How America Pays for College. Retrieved from https://www.salliemae.com/content/dam/slm/writtencontent/Research/HowAmericaPaysforCollege2021.pdf.

While nearly half of the funding for college education in the 2020-2021 academic year came from parent income and savings, this will not necessarily be the reality for Candice. Since her parents have not set aside specific savings for Candice's education, let's explore potential options for her.

Exploring Federal Student Aid

As Will and Dianne have not been saving toward college education costs for Candice over the years, they've decided to begin with exploring Candice's eligibility for federal student aid. Federal student aid, as they learned, is based on a seemingly simple calculation:

Cost of Attendance (COA) – Expected Family Contribution (EFC) = Financial Need

Cost of attendance includes the total amount necessary for going to school, including tuition and fees, room and board or living expenses, books, supplies, transportation, loan fees, miscellaneous expenses, an allowance for the child or dependent care, cost related to disability, and reasonable costs for eligible study abroad programs. While these costs may not be applicable in every situation, the calculation considers each for determining financial need.

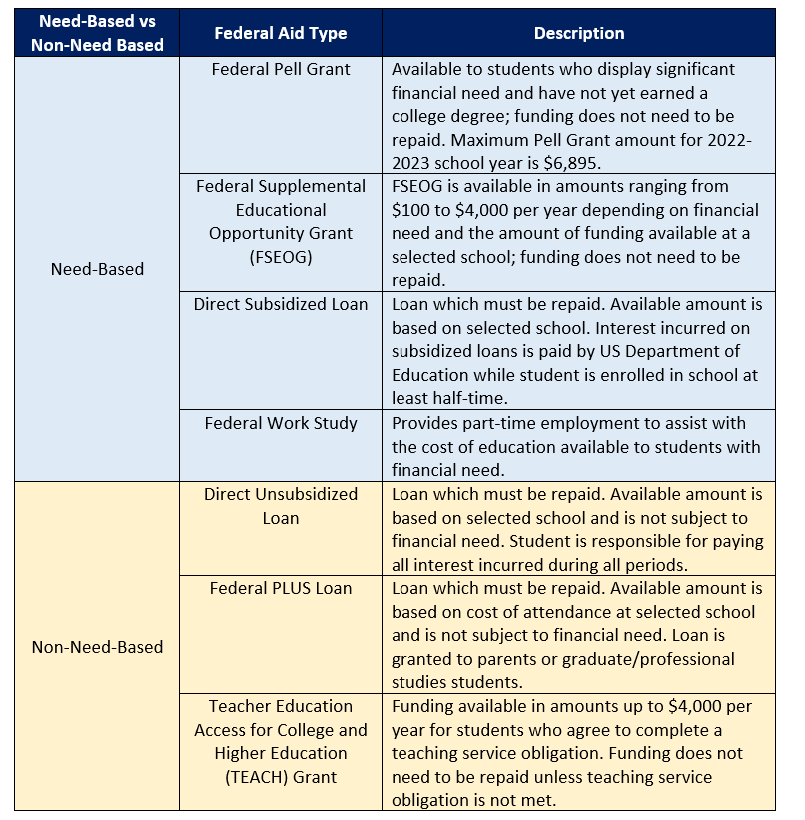

The Expected Family Contribution or EFC, on the other hand, is a figure used to determine how much financial aid would be received when attending a specific school. The formula used to calculate EFC is determined by the law and based on information reported on the Free Application for Federal Student Aid (FAFSA). The EFC uses separate calculations for dependent and independent students with or without dependents or spouses. Based on the results of the EFC, a student can be eligible for need-based federal student aid programs such as the Federal Pell Grant, Federal Supplemental Educational Opportunity Grant (FSEOG), direct subsidized loans, or federal work-study. In addition to need-based financial aid, non-need-based financial aid is also available. Non-need-based financial aid includes federal student aid programs such as direct unsubsidized loans, Federal PLUS Loans, and the Teacher Education Access for College and Higher Education (TEACH) Grant.

After a review of the federal student loan options, Will, Dianne, and Candice want to continue exploring other available sources to cover Candice's higher education costs. We will continue our deep dive in Paying for College Part II.